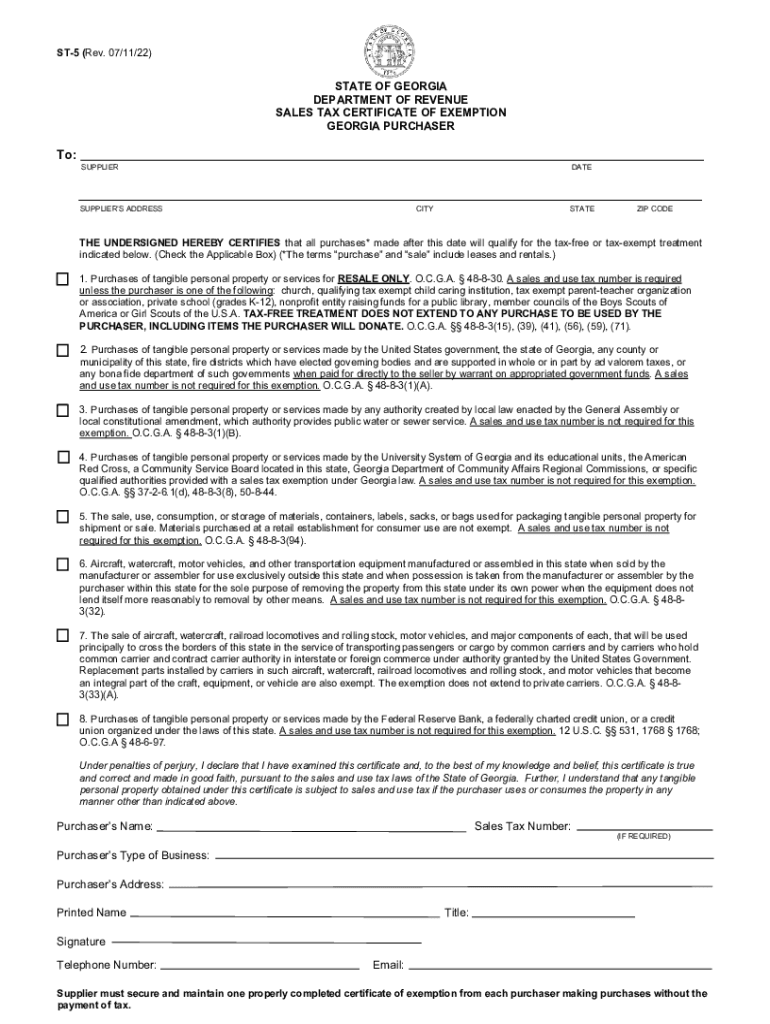

Who needs an ST-5 form?

This form is used by taxpayers in the State of Georgia. It is not requested from all taxpayers. Only exempt organizations that have a Certificate of Exemption from the Commissioner of Revenue need to file this application in order to purchase items without applicable sales taxes.

What is the purpose of the ST-5 form?

Form ST-5 stands for a Sales Tax Exempt Purchaser Certificate. An agent representing an exempt organization must provide this certificate to a goods or service provider to inform him that no sales tax should be withheld from this purchase.

What other documents must accompany the ST-5 form?

A goods or service provider may request a copy of the certificate as evidence that the organization is entitled to an exemption. An organization may request this type of certificate by filing form ST-2 with Georgia Department of Revenue.

When is the ST-5 form due?

The Sales Tax Exempt Purchaser Certificate must be presented upon making a purchase.

What information should be provided in the ST-5 form?

The filler has to indicate the name of the supplier, date of purchase and address, describe the purchaser’s business activity, business name, business address, sales tax number, and purchaser’s name.

The filler also must check the appropriate checkbox with the purpose of the next purchase or leasing of the property.

The purchaser also has to sign the certificate.

What do I do with the Certificate after its completion?

The completed ST-5 form is forwarded to the seller. The dealer should maintain a copy of the certificate to be presented in case of an audit.